- 2020/02/20

- 26198

- 271

Co-creating New Ecosystems for Technology-based Services- Inspiring an Innovating Future with Taiwan’s Industries

ITRI merged the Industrial Economics and Knowledge Center (IEK, established in 2000) and ITRI International Center (IIC, established in 2006) in August 2018, and formed the new Industry, Science and Technology International Strategy Center (ISTI). The mission of this new Center is to understand global advanced technology trends and facilitate collaborations among international and Taiwanese industries and technical R&D agencies, subsequently making Taiwan a key partner in the global innovation ecosystems. We aim to enhance the additional value of industries while seeking an overall balance among economy, society, and our environment.

As ISTI celebrates its first anniversary in 2019, the Center will continue to work in tandem with ITRI’s 2030 Technology Strategy & Roadmap in the near future. Furthermore, after many internal strategic discussions, ISTI set its 2025 vision as to “Inspire science-technology innovation and value-up for Taiwan industries.” The Center will also be leading four important missions:

- Technology Scouting: Monitor advanced technology and new emerging markets.

- Ecosystem Networking: Connect the global innovation ecosystem network.

- Strategic Partnering: Collaborate with technical research strategic partners to co-create the future.

- Capability Boosting: Enhance the overall innovative technology R&D capabilities of industry, academic and research agencies in Taiwan.

The former IEK is now renamed as IEK Consulting and continues to promote industry and science and technology R&D results and consulting services. The annual research publication IEKTopics provides research results and development policy suggestions related to industries and major technology issues important to Taiwan in the next five years. Past topics covered include:

- 2018: 2030 Advanced Technology from Asian Perspective

- 2017: Sustainability: Circular Regeneration for Innovation Economy

- 2016: Solve Problem: Smart Innovation, Happy City

- 2015: Driving IoT at Full Steam for First-Mover Advantages

- 2014: Triumph in Future: Envision Lifestyle to Lead Innovation

- 2013: Rally to Victory: Advanced Manufacturing as New Power for Taiwan

The theme for the 2019 issue is "Ecosystem Creation: Science-Technology Value-added to Converging Services." As the development of global digital technology accelerates, innovations and revolutionary models are rapidly developing, already causing significant challenges for leading technology companies in Taiwan. The domestic service industry, which comprises over 60% of domestic GDP and employment, and manufacturing SMEs, which make up 96% of the overall manufacturing sector, have both long lacked innovation momentum and face difficulty attracting technical professionals. This situation may lead to challenges and difficulties in future transformation and upgrading, and brand value enhancing. Additional issues such as long-term low wages, brain drain, aging society, and low birth rate also mean that the government should begin to support local service industries and manufacturing SMEs as soon as possible.

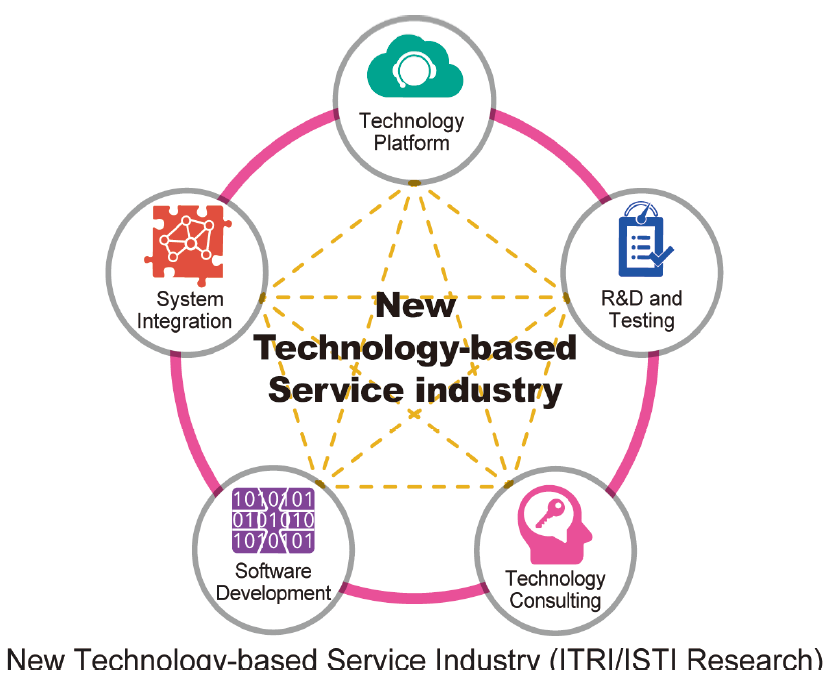

The IEK Consulting team has conducted surveys and concluded that Taiwan should cultivate technology-based services industry based on emerging technologies. Through professional service consulting, planning, and the introduction of technical applications, industries can digitalize their businesses and enjoy the benefits of technology. By establishing “New Ecosystems for Technologybased Services”, Taiwan's industries can create new blue ocean opportunities and succeed in the international market. After considering the specific demands of application services in industries, the team has come to the conclusion that there are five major “New Technology-based Service Industry” categories that would require extra attention and support from the government:

- Software Development Service

- System Integration Service

- Technology Platform Service

- R&D and Testing Service

- Technology Consulting Service

Taiwan has been focusing on software development and system integration to reinforce its existing advantage in hardware manufacturing. As for the other three service areas, Taiwan has not yet matched up with international levels and trends.

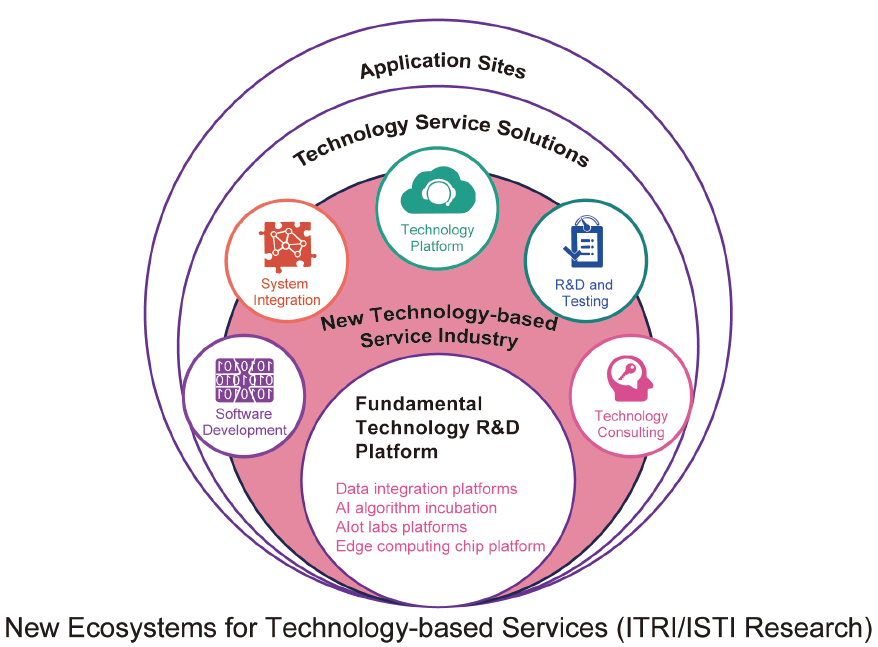

Take TSMC, the benchmark of innovative technology industrialization in Taiwan, for example. The company created a world-grade foundry industry through innovative business models and by connecting with domestic and international industries, the academia, and research organizations. TSMC helped global IC designers develop Fabless applied service industries that are asset-light and have high additional value, and also linked the ICT Silicon Island industry cluster in Taiwan, creating NTD 2.6 trillion worth of semiconductor output value and a total of 225,000 jobs in 2018. Supply chain and income consumption benefits created an additional output value that was 1.2 times larger and increased employment opportunities by 2.6 times. Therefore, for Taiwan's service industries and manufacturing SMEs, we hope the government can set up basic technology R&D platforms in different digital technology fields, including National databases x AI, AI x Edge computing, and 6G x Smart city/rural. Because the advanced basic technologies required in these industries demand continuous large-scale R&D, and connections and collaborations with global partners; and these conditions cannot be fulfilled by individual SMEs alone. Constant investments and support from the government and R&D agencies can greatly benefit startups and creative young entrepreneurs in the five major New Technology-based Service Industries. This can establish New Ecosystems for Technology-based Services in Taiwan and realize the following five major objectives which will transform and stimulate our industries and overall economy.

- Help service industries and manufacturing SMEs upgrade and transform.

- Stimulate innovation and encourage young entrepreneurs to start their own businesses.

- Encourage industry professionals to improve and grow and offer an international platform for the best to learn from each other.

- Combine digital lifestyles with Taiwanese local culture and experiences.

- Become an indispensable key partner in the global ecosystem.

Apple founder Steve Jobs once said, "Fairchild Semiconductor is like a mature dandelion. When you blow it, the seeds of this entrepreneurial spirit are flying around with the wind." TSMC founder Morris Chang also mentioned in his biography that Fairchild Semiconductor is the first company to specialize in silicon and later generated many spin-off semiconductor companies. Thus, the cover of this year IEKTopics depicts dandelion petals and seeds spread out in the wind, eventually landing and blossoming into an endless natural ecosystem. This indicates that we hope to lead the development of New Technology-based Service Industry, encourage more young innovators to leverage the rich foundation of digital technology, and help local service industries and manufacturing SMEs create Taiwan's New Ecosystems for Technology-based Services which will push Taiwan’s economic development, along with technical development and culture transmission, to new heights!

New Ecosystems for Technologybased Services to Ignite Digital Transformation in Taiwanese Industries

The Rise of New Technology-based Service Industry Stimulates Industrial Digital Transformation

As technology rapidly develops, new types of business models are also appearing and growing at impressive speed. New technology companies such as Amazon, Facebook, and Google have less than ten to twenty years of history, yet their current market values are among the global top five; and startups such as Uber and Airbnb managed to set up operations worldwide within less than ten years. These companies have completely disrupted traditional transportation and tourism accommodation market structures and are now the largest transportation and accommodation operators in the world. It is worth noting that these new companies do not consider themselves the same as traditional industries; instead, they all belong to a new industry positioning - the New Technology-based Service Industry.

The service industry is an industry with a higher value-added and has always taken up the most significant percentage among all industries. In Taiwan, the service industry contributes to 63.2% of the total GDP (2018); and while there are different service types, the overall average added value is 66.2%. However, although the domestic service industry brings in the highest percentage of GDP and has high added value, this is mainly the fruits of labor-intensive wholesale and retail industries and not of high-profit industries. Therefore, we need to increase the overall value of the service industry to increase its non-labor added value. In addition to introducing knowledge-intensive professional services, using technology tools to improve service industry operation efficiency is key in this digital era. Nevertheless, if we look at the current industry status, while large enterprises or new startups may be very comfortable with technology, the service industry and manufacturing SMEs find it relatively challenging to harness technology to improve their services or production operations. Thus the New Technology-based Service Industry will be crucial in leading industrial digital transformations.

High Hardware Equipment Spending - Potential Opportunities for the New Technology-based Service Industry

As it rapidly evolves, technology plays an increasing role in our daily lives and industry operations. We expect to see considerable potential business opportunities for technology deployment in various areas. Nevertheless, although Taiwan is a major technology product manufacturing country, our level of technology application is still a large step behind other countries such as the US and Japan.

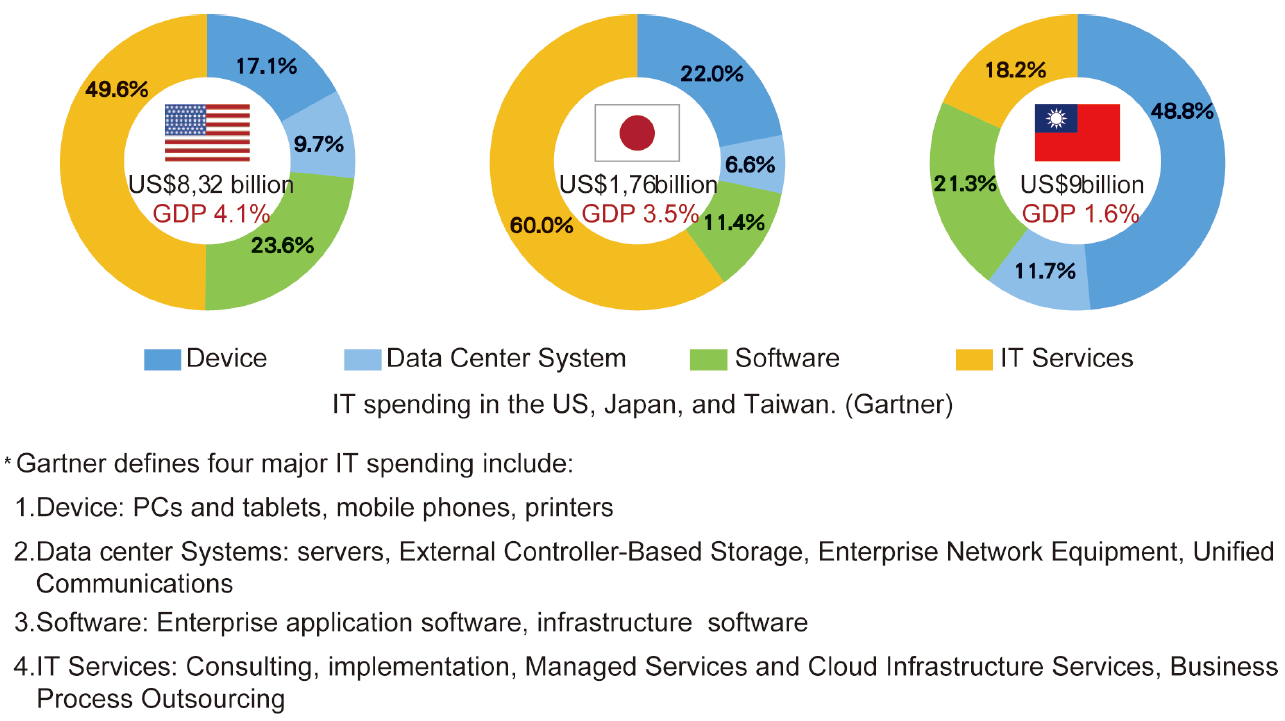

We analyzed statistics from Gartner's 2018 report which covered an overview of IT spending in the US, Japan, and Taiwan. IT spending include four categories: terminal equipment, data center systems, software, and technology service. In the following diagram we can see a significant structural difference in IT spending among the three countries: the IT service category in the US and Japan reach 49.6% and 60.0%, respectively; yet Taiwan only has 18.2%. In terminal device, US and Japan only has 17.1% and 22%, while Taiwan reaches 48.8%. As for the percentage of overall IT spending in GDP, US has 4.1%, Japan 3.5%, and Taiwan only has 1.6%. From the above analysis, we can see the differences between Taiwan, the US, and Japan: although Taiwanese manufacturers produce the majority of global technology products, the overall IT spending of Taiwan is relatively low. Taiwan should increase its IT spending, if we wish to become a major tech country. Furthermore, we can see in the structure of IT spending that in Taiwan, almost 60% of the amount was spent on procuring hardware equipment. The market spent less than 20% of total technology expenses on procuring technology services. This indicates that Taiwanese industries are still rather conservative when it comes to digital transformation. Most of the local businesses would rather spend budget on buying equipment and are less willing to introduce technology services into their operations and invest in software that maximizes equipment efficiency and value. This situation is commonly found in manufacturing SMEs and traditional service industries. As the digital transformation era approaches, Taiwan's industries need to give up the concept of simply procuring products to solve problems. It is easy to get technology products, but to enjoy the synergy of technology applications requires the involvement of professional service providers to achieve appropriate integration.

Five Major New Technology-based Services to Implement Technology Application Value

Taiwan is at the threshold of digital transformation. Domestic industries should speed up technology deployment and discard the outdated mindset of “digitalization means buying more equipment”. In order to actually leverage technology to help industries execute digital transformation, businesses must be prepared to spend technology expense budget on introducing technology services. We strongly support the promotion of New Technology-based Service Industry in Taiwan, so that businesses can truly enjoy the values brought forth by technology after they conduct digital transformations via professional service consultation, planning, and introducing technology applications. The New Technology-based Service Industry is crucial in this wave of industrial digital transformation will be implemented in industries and daily life by connecting IoT digital technology infrastructure with interdisciplinary third-party platforms.

According to the actual application demands of industries, services that the New Technologybased Service Industry provides can be categorized into the following five major areas (as shown in the following diagram):

- Software Development Service: provide customized software development services according to the client’s application environment conditions and needs. Scope of service include system analysis and software for developing applications, to terminal applications (such as apps and web interface software) and/or back end management systems, and maintenance and software and system upgrading services. New software development services include AI algorithm program development and setting up a machine learning system environment with data provided by the client. Current operators include Galaxy Software Services Corporation (CRM company), Groundhog Technologies (telecom network optimizing software company), and Digital Treasury Corporation (block chain software developer).

- System Integration Service: traditional system integration services focused on solutions that included software, hardware, and networks. Now the new generation of system integration services leverages emerging technologies and cloud resources to help clients integrate and develop single or multiple new technology systems, and build a system environment that meets the client's business operation needs according to the business' digitalized operation conditions. Local large system integrators include Systex Corporation, MiTAC Information Technology Corp., and Tatung System Technologies Inc.

- Technology Platform Service: provide general or customized professional technology services which the client can access through an internet platform. This type of platform can be used in many business models, for example, B2B professional applications (e.g. IBM Watson AI platform, Foxconn Industrial Internet (IoT)) and B2C resource and service matchmaking (e.g. Uber, Airbnb, TutorABC). Through these technology platforms, professional services can be utilized to help traditional industries quickly execute digital transformations and greatly reduce technology application challenges for SMEs and traditional service industries.

- R&D and Testing Service: equipped with product and technology R&D capabilities and complete R&D and testing environments, the Industry can conduct R&D testing on behalf of their clients. Clients can focus their energy and resources on core competitive products since they do not need to invest in R&D equipment and related resources. Institutions that offer these services include legal persons/NGOs such as ITRI and the Institute for Information Industry, and other R&D agencies in universities.

- Technology Consulting Service: provide services such as technology application planning, business model design and assessment, and service process design. The Industry offers consulting and professional technology application deployment and planning services to help solve business pain points, enhance business operation procedures, and increase operation efficiency. In the past, Taiwan's businesses usually sought technology consulting services from foreign companies such as IBM and Accenture; now domestic system integrators are able to offer consulting services as well.

Creating New Ecosystems for Technology-based Services to Provide Comprehensive Industry Digital Momentum

The emerging technology market is the new battlefield for global businesses, yet it would be impossible to enter this new market with traditional product marketing mindsets. Compared with large foreign technology service corporations which have abundant resources, the advantage of Taiwan's technology service businesses comes from effective collaborations within the service industry ecosystem which also increases the competitiveness of domestic industries. Therefore, we suggest the government should support Taiwanese schools, NGO R&D organizations, and large technology companies with R&D capabilities to jointly set up a fundamental technology R&D platform to reduce R&D cost of domestic businesses and shorten services time-to-market. We suggest that the academia and R&D faculties work together to set up the following platforms:

- Data integration platforms: integrate open data from government agencies, encourage data exchange in the private sector, or establish data trade mechanisms to develop a national-level data mart. This will increase public trust and confidence on data applications and the act of using this data as basic resources to develop AI.

- AI algorithm incubation platforms: leverage academia and NGO R&D capabilities, resources from the National Center for High-performance Computing, and big data from the nationallevel data mart to further understand industry needs and develop the required AI algorithms for each industry. The academia and R&D organizations can develop AI algorithms, and New Technology-based Service Industry operators can then access the algorithms through licensing and use them to develop new technology-based services.

- AIoT labs and display platforms: use open government spaces (public spaces, national parks, forests, airports, roads, etc.) as AIoT development test bed for technologies such as next gen telecom, various edge computing sensor devices, and soft and hardware system integrations. Taiwan's Center of Excellence for Technology Solutions will also be set up in science parks to showcase product R&D and software and hardware integration capabilities of local businesses.

- Edge computing chip platforms: developed in concordance with the next generation of edge computing trends, these platforms combine the R&D capabilities of industries, academia, and research agencies to develop chips that will be used in the next generation of AIoT related applications in different areas (e.g. AR/VR applications), various sensor applications (image sensors, material sensors), V2X (IoV), and next generation communications. The R&D results can also be used by local system integrators to develop new technology-based products and services.

In addition to the five major new technology-based services and fundamental technology R&D platforms, the ecosystem also has other external supporting resources such as third-party services (e.g. cash flow, logistic platforms, etc.), IoT technical infrastructure (telecom networks, various sensors, wearable devices, etc.), open source code communities that provide software development resources, and cloud data centers for software system operations and data storage. By integrating these horizontal resources, the New Technology-based Service Industry can further focus on its core professional services. The Industry aims to not only assist traditional IT service industries, but also transform them into a member of this new industry by utilizing new emerging technologies to help traditional businesses repackage their existing products and integrate software with service elements. New technology-based service emphasize on usercentric professional integration and value co-creation. In recent years, a wave of new business models that exist on mobile devices and leverage IoT, big data, and AI technologies via broadband internet have gradually appeared. For example, Uber founders saw the trouble travelers had to go through to find transportation means and created the Uber platform which disrupted the traditional transportation and logistics model. Similar business models have also appeared in different fields: Swedish medical startup KRY noticed the public's hurdles when they needed to see a doctor and found the medical clinic platform. Patients and doctors who are currently not working at clinics can be connected via cell phone and doctors can give medical advice online. Unicorn Rubicon Global saw that stores and government agencies had problems finding recycling companies to dump trash, so they used technology platforms to match stores that are looking for recycling services with moving haulers and recycling operators to solve the problem and created further value for recycled resources. The emergence of New Technology-based Service Industry operators improves overall industry operations and allows labor and other social resources to be used more efficiently. Moreover, New Technology-based Service Industry is not exclusively for startups. We look forward to seeing more traditional businesses with rich practical experience leverage tools of technology and valuable skills to become part of the New Technology-based Service Industry.

New Trillion-Dollar Blue Ocean Industry to Help Taiwan Secure Role in International Market

According to statistics from the Ministry of Economic Affairs Industrial Development Bureau, the total value of Taiwan's overall computer program design, consultation and related IT services in 2018 is NTD 346 billion. To keep up with global digital transformation trends, Taiwan should deploy New Technology-based Service Industry in various areas with its existing IT service industry as a foundation. Taiwan's current industrial and service industries have approximately NTD 30 trillion of production value, so if we conservatively estimate that 3 - 5% of this value is transferred to the New Technology-based Service Industry in the future five years, we can generate NTD 1.5 trillion through industrial upgrading and transformation. If we set the CAGR as 8% (a relatively higher percentage for emerging industries), then by 2030 the industry will be worth NTD 2.2 trillion. Vertical integration of traditional industries has reached its growth limit. Interdisciplinary horizontal integration will form the new ecosystems for the next generation of industry development, and technology application can effectively speed up the integration process.

The New Technology-based Service Industry not only further highlights Taiwan's technology application capabilities in industries, but also helps industries operate more efficiently through technical transformation. By leveraging the borderless internet, Taiwan has the potential to export technology-based services in addition to hardware. Furthermore, large-scale technology system integration solutions provided by domestic businesses in recent years can also be exported. As industries are facing digital transformations and technology advancing, Taiwan should work to secure our crucial role in the global technology industry supply chain. Besides continuously providing key components for global technology ecosystem operations, we should actively think about future transfer directions of industry models. Taiwan has always been on the leading edge of technology development, and now we need to develop interdisciplinary technology application capability so that local industries can surf on the blue ocean of the global market.

New Technology-based Service Cases

Software Development Service

Case #1: Mobile Data Software Service (Groundhog Technologies)

Groundhog Technologies is the first technology company in the world to develop big data technology related to mobile communication based on moving behaviors of phone users. The initial technology, which originated from MIT, is mainly used to assist telecom operators to optimize their network signals. Groundhog Technologies first developed their client base in the US and European markets, and gradually expanded into South East Asia, the Middle East, the UK, and Singapore. The three major telecom companies in Taiwan are also clients of the company. Groundhog Technologies later developed the mobile communication big data analysis service which uncovers new business areas for telecom companies. Telecom operators can deploy customized software to analyze mobile user data collected at base stations, and the results can be used for mobile advertisements, outdoor advertisements, research and studies on people flow and transportation tracks, and targeted marketing in different industries.

Case #2: Blockchain Software Service (Digital Treasury Corporation)

Blockchain is currently one of the latest software development technologies. It can be applied in both financial and non-financial sectors, various industries, and personal health and medical care. Digital Treasury Corporation specifies in leveraging blockchain and data analysis technologies to offer an array of decentralizing business application services that can be deployed in biotechnological medicine, health and medical care, energy markets, and asset management. The company utilizes distributed ledger technology and related applications developed via software on world-famous blockchain platforms, such as Ethereum, to help business clients leverage blockchain technology and set up a mixed blockchain platform for digital currency and asset trading, supply chain tracking, medical records and data management, product traceability, smart contracts, and other applications. Currently Digital Treasury Corporation is using blockchain technology to help the Tao people in Orchid Island set up a digital ID and regional digital currency system.

System Integration Service

Case #1: Smart Technology Shop (ITRI)

ITRI’s Service Systems Technology Center joined forces with local companies Advantech Co. and M2COMM to help local convenience store brand Hi-Life develop smart technology stores. The project provides four main services: (1) Accurate stocking and picking: develop AI demand prediction and storage decision technologies, and introduce AI high-density dynamic storage picking decision technology into warehouse operations to help the brand system overcome bottlenecks in completing virtual and physical orders. (2) Automatic inventory mobile vehicle: robots can quickly finish the daily task of stock inventory. This lessens the workload of employees and reduces man-made mistakes. (3) Digital labeling: use WiFi to connect managed digital labels in place of traditional paper price tags. This allows more flexibility in latest updates on correct product information and promotion deals. (4) Volume identification: this technology is developed due to the needs of e-commerce product deliveries. Consumers can measure the package size by themselves to increase fee quotation accuracy and delivery efficiency.

Case #2: E-Gate System Integration (MiTAC Information Technology Corp.)

MiTAC Information Technology Corp. is one of the top three system integration providers in Taiwan. As a SI and IoT solution provider, MiTAC offers sensor technologies, application services and operation platforms that can be applied in electronic ticket systems, smart libraries, digital finance, and smart medical care. Examples include the ETC electronic toll collection system, traffic monitoring systems, HSR and metro automated fare collection systems, and the E-Gate system at airports. MiTAC's E-Gate system solution includes an automated customs clearance system, entrance and exit checking system, and automatic gates. The automated customs clearance system covers functions such as face recognition, fingerprint identification, barcode reading, and passport identification, allowing travelers to easily go through immigrations by themselves. Currently the E-Gate system is already deployed at Taiwan Taoyuan International Airport and has also been exported to Manila Ninoy Aquino International Airport and other three airports in the Philippines.

Technology Platform Service

Case #1: Cofit Platform (COFIT)

Borrowing the open platform concept from Uber, COFIT assembles the expertise of dietitians all over Taiwan to offer personalized dietary and health management services. The collaboration leverages AI NLP (natural language processing), chatbots, big data, and algorithms to provide services to three sides: (1) Supplier side: connect dietitians and workout coaches, and offer online health management CRM systems to set up more efficient and real-time services. The service will also collect data and establish a Food Database to provide faster analyses on calories and nutrition. (2) The Cofit platform: major development and services of this platform include a collaboration platform for professional coaches, intelligent assistance teachers supported by AI, automated calculation and generation of health goals, and healthy diet parameters recording. (3) User/demand side: through the app, users can interact with other people in health-themed communities, receive health and nutrition knowledge, track and manage diet data, and access other services to help them self-manage their health and diet.

Case #2: TradingValley

TradingValley is a financial management platform company that developed a financial technology robot to assist in management and investing. The company, which was set up by a group of people born in the 80s who enjoy investing and financial managing, is dedicated to creating personalized financial management bot services with data technology to help independent investors with various backgrounds, requirements, and financial goals form a customized and suitable investment portfolio in this complex investment environment. Bot services can reduce irrational factors and improve investment decisions. To comply with financial regulations in different countries, TradingValley offer B2C services in the US and B2B services in Taiwan. In the US, the company has a legal investment consultant license and is allowed to offer investing suggestions to the American public. By conducting AI econometric analysis on US stocks sand US ETF, TradingValley can suggest investment targets that have potentially higher return rates. In Taiwan, TradingValley offers its services through a B2B model. They seek collaborations with financial businesses and provide the company’s financial management algorithm engine and AI market prediction engine as services via cloud. The AI algorithms generate predictions on different markets, allowing investors to deploy their assets dynamically and agilely to increase overall portfolio return rate. Furthermore, considering stock trades require a trading platform, TradingValley is working with SI information service providers to deploy the services quicker.

R&D and Testing Service

Case #1: Aldea co-creation platform (ITRI)

The co-creation platform AIdea developed by ITRI aims to leverage crowdsourcing and open problem-solving methods to reduce the time required to match and transfer academia/ innovative AI algorithms to local enterprises. This can lower the threshold of problem solving in industries and help them access algorithms faster for development or application. The platform also provides a practical testing space for domestic professors developing machine learning/ deep learning courses, consequently contributing to Taiwan’s high-level AI professional training. AIdea is also a very suitable platform for problem solvers to explore possible solutions via PoC methods. Businesses may wish to test if certain issues can be solved with new AI technology; and before they actually invest resources into the projects, they can go on AIdea for external academia consultation to understand to what degree can these problems be solved, or even set benchmarks for future investment target settings. The platform also serves as a channel for finding new talents as when a business decides to invest in a new project, an evaluation mechanism will show the top teams in the field, and these people will obviously be the business’ priority collaboration partners.

Case #2: Cyber-Physical System (ITRI)

ITRI helped Taiwanese waterware industry upgrade and automate their grinding process: the Cyber-Physical System (CPS) developed by ITRI can compensate for the absence of senior workers’ experience and skills. By combining sensors, communication devices, controllers, and other equipment and technologies, CPS can calculate and automatically generate grinding and polishing programs for the robots. The complete programming information can then be transmitted in real time to the robot via communication networks, and sensors record processing tracks to optimize grinding and polishing operation procedures. ITRI developed this digital technology to carry on the experience and skills of senior workers. The new technology also means manufacturers do not need to solely rely on manual experience and labor and can significantly reduce the time required to recalibrate grinding robots. Combining the traditional with the future, abstract skills can now be converted into parameters for concrete procedures, increasing craftmanship value of the robots and upgrading the traditional industry.

Technology Consulting Service

Case #1: Weather Consulting Service (WeatherRisk Explore Inc.)

WeatherRisk Explore Inc. analyzes big data on weather to provide business clients with detailed weather reports of their event location. Compiled by a team of weather analysts with weather forecasting licenses., the report, which can cover a maximum period of 14 days, includes hourly weather overviews, wind and rain forecasts, and evaluations on how weather conditions may affect the event. In addition, the company provides services to the wind power industry, starting from marine and weather analyses during the planning stage, weather forecasting and decision-making systems during construction, to power generation volume estimation during operating periods. WeatherRisk Explore combines global technologies to offer localized, detailed, and customized marine and weather consulting services that meet international standards.

Case #2: Production Line Diagnosis Consulting Service (TAO Info)

Manufacturing industry production line diagnosis is a popular technology consulting service area. Bringing a big data analysis perspective to the market, TAO Info helps manufacturers examine their production line and quickly identify the cause that is affecting their production quality. For example, procedures in the semiconductor industry are complex and massive. When businesses find problems in their products, going through the entire production line to figure out the problem manually is an immense challenge. TAO Info collects production line data to form a data analysis model. AI algorithms are used to define the problems, then big data analytics are deployed to quickly zone into potential key factors from thousands of production parameter data. TAO Info's technology service can effectively reduce the engineers’ workload when they are trying to pinpoint the cause in the entire production line as this technology can swiftly narrow down the problem area and find the cause and bottleneck in the production line.

Cultivating an Excellent Development Environment to Stimulate New Technologybased Service Industry Progress

Innovative Technology Key Indices for People-centric Service Solutions

The next generation of industrial transformation and upgrading will be driven by the Digital Model, and the global digital economy output value is expected to reach USD 120 trillion in 2030. The 2018 Digital Transformation Initiative announced by the World Economic Forum (WEF) listed out seven key new technology-based items (AI, autonomous vehicle equipment, big data analysis and cloud computing, customized manufacturing and 3D printing, IoT, robotics and unmanned vehicles, social platform) which will not only drive industrial transformation and service innovation, accelerate the development of innovative products, services, and business models; but also further shape the New Ecosystems for Technology-based Services. Businesses should integrate

interdisciplinary technical fields and leverage their innovation and startup capabilities to increase the innovation synergy of industrial technology. Over 75% of businesses in vertical industries such as retail, health care, financial services, green energy, circular economy, and logistics and transportation, are expected to utilize technology to provide innovative services, especially to create additional value through business data analysis. Companies can make use of the resources and gradually implement them in applications including enterprise upgrading and transformation, core system improvements, cloud services, and data security. In other words, innovative technology is quickly becoming a new leverage point for service experiences.

The service industry and manufacturing SMEs are important foundations of Taiwan's economy. In recent years, startups founded by young people has become a major trend in Taiwan, and it is also a significant area for technology application and deployment. The present environment has to deal with crucial issues such as low level of R&D investments in the service industry and relatively small export scales; and the challenge for future new technology-based servicesis to find innovative ways for new breakthroughs and set up people-centric service solutions. The keys to success for Taiwanese industries’ development lay in seeking new solutions, technologies, and service-led business models; and understanding the demand of the markets, industries, and society. Industries should leverage innovation to increase brand value, strengthen cross-sector service integration and local field testing to fully unleash the overall effects of existing hard and software and build New Ecosystems for Technology-based Services.

Key Point #1: Targeting the big data era and setting up a data integration platform

The most important resource in the 20th century was petrol. The country who controlled petrol could sway the direction of international trends. Now big data is considered “the new petrol of the 21st century” and is a “bottomless gold mine”. Many countries view big data as an important core asset. In 2007, petrol company ExxonMobil had the highest aggregate market value in the world; but ten years later, in 2018, the top five companies with leading market values were companies that actively collected and handled big data: Apple, Amazon, Google, Microsoft, and Facebook. ExxonMobil had fallen to number eight on the list.

The most precious resource in the world is no longer petrol, but data. Competition between international enterprises will expand from traditional energy sources to data resources. According to the estimation of research & survey agency IDC, global data resources will grow from 16 trillion GB in 2016 to 163 trillion GB in 2025, meaning the volume will increase tenfold within ten years. Right now, a lot of industry developments are built on internet technology. Big data analysis helps businesses in various fields decide on different applications in their marketing developments, business operation management, and internal risk managing and control. Currently over 90% of the top 500 global enterprises leverage advanced data mining and analytics to make important decisions. Big data is the absolute element and key for future global industry development and survival.

In recent years, country governments are actively expanding big data applications and quickly launching open data policies. This not only increases governance transparency, businesses and the public can also use the data to stimulate domestic economic activity, improve business service quality and operation efficiency, and consequently spur on overall economy.

Taiwan has been pushing for open government data for years, yet most of the open data available now are statistical data and academic data. It is still very difficult to obtain and use data from the public sector due to internal organization regulations and/or related legal restrictions. Yet data that cannot be used has no value. As for data related regulations, such as the Personal Data Protection Act, they still lack concrete execution standards or methods which restricts the flexibility of data collection and usage, and cross-department data fusion.

The U.S. Commission on Evidence-Based Policymaking suggested passing laws to set up a National Secure Data Service (NSDS) to address governmental issues concerning data usage, privacy protection, and evidence building abilities. NSDS is a service environment for data linking and safe access, and does not require data storage systems. The idea is to protect data usage transparency and privacy while integrating data needed for specific projects and set up temporary connections. The links and integrated data will be terminated after a certain period of time after the project is completed. The US federal government also simultaneously set up a supervising organization to draw up performance indicators, review new privacy tools, set up complaint handling and execution procedures, and conduct strategic planning. Furthermore, the U.S. Commission on Evidence-Based Policymaking provided revision suggestions on regulations related to data processing, including public disclosure procedures of anonymized confidential data, and pushed for state governments to collect work-related data to be used for statistical data and the setting up a database.

New Technology-based Service Industry is the foundation that supports industrial digital transformation. And data is very crucial in this transformation. How to safely and efficiently conduct data trading and integration and create higher value through different cross-applications will be an important topic for the development of New Technology-based Service Industry. We suggest that Taiwan can set up a specific national-level agency responsible for data services to provide a safe data usage and trading environment. The government should also revise regulations related to open data to protect privacy and help New Technology-based Service Industry unleash data value to accelerate Taiwan's industrial digital transformation.

Key Point #2: Integrate vertical application value chain and set up innovation verification fields

The application of new technology will generate an increasing amount of data in different formats and types at geometrical speed. Combined with AI algorithms, IoT devices, business service platforms, back end smart services, and high-speed computing capacities, this huge amount of data can fully support the new developments of our digital economy. In addition to developing new products, services, and applications, this new trend will also change the existing industry ecosystem and offer cross-section integration services. The strategic promotion of important vertical application value chains should be prioritized in order to stimulate initial market development of new technology-based services that is generated in concordance with public demands and market development maturity.

New technology should be applied in public spaces and create rigid demand. With the objective to improve public living quality and solve regional social issues, the government should host innovation related events such as Hackathons and innovation application presentation and exhibitions to set up an innovative technology application environment. Also, to fulfill public policies and/or other city demands, the government should initiate localized innovation application services, and use public services to support New Technology-based Service Industry application development and testing. In addition to zoning into killer innovative services from a pile of cases with business transfer and marketization potential, related government departments can help connect government agencies or venture capital resources to optimize and encourage technology use in industries, and speed up innovative value-added developments in new technology-based services.

Since resource consumption rate and risks are relatively high during the initial stages of new technology-based services developments, the government should implement a “Basic + Add-on” development strategy. Government agencies or NGOs should combine technology R&D resources to set up the basic requirements for all industries, for example, 5G communication environments, cloud services, smart sensors and related hard and soft infrastructure, so that businesses have the basic technology to further develop the shared resources. Individual businesses should be able to implement cost-effective cooperation models, such as technology licensing, benefit sharing, or paying user fees, to conduct specific product and service development, testing, and verifications on this technology platform. The government can assist by providing subsidies, investment reductions, and other tax benefits. In addition to encouraging SMEs to introduce innovative technologies into their operations and spur on industry investments, the government should set up platforms for technology transfer and matchmaking, provide presentation opportunities to showcase innovative technology applications and results, and facilitate cross-sector/industry cluster exchanges. This will set up New Ecosystems for Technology-based Services, and along with demo testing spaces, generate innovative technology application situations and potential benefits. The government should also set policies that will stimulate integration and development in industry ecosystems, reduce the time for innovative ideas to be realized and hit the market, and speed up marketization for new technology-based services.

The government should provide comprehensive innovation regulations, optimize industry development foundations, and assist businesses that are willing to invest in R&D and services related to new technology-based service applications, including unmanned vehicles, autonomous driving equipment, remote medical care, and financial services and paying method technologies. Public sectors can also connect them with related authorities for interpretation and loosening up of regulations in order to speed up innovative service expansion. As for some advanced technology products that are still in initial testing stages and cannot be transferred to businesses or markets yet, the government should plan and build new verification fields and open public spaces for cross-sector product and service prototype verification and testing. This will encourage society to participate in creating innovative technology solutions and let service providers and the public understand each other better. Data collected during the processes can galvanize adjustments and optimization of innovative products and services.

Key Point #3: Entering the international market with strategic partners.

New technology-based services encompass a wide scope of items. Unlike past development strategies which prioritize on the competitiveness of products and services, the main challenge for new technology-based services is how to go from 0 to 1. To ensure their innovative services have a basic consumer crowd during its initial development stage, startups need to understand social issues and consumer demands, and be able to handle different testing spaces and application situations while solving problems raised by different parties in the market. In other words, startups should learn to satisfy specific target market demands via practical testing and applications. By verifying the actual results and effects of innovative service models, startups can help New Technology-based Service Industry operators check and complete adjustments in areas such as target consumers, pricing strategies, marketing channels, and service models. Furthermore, the players can look for innovation bases and innovator spaces with innovative technology startups that have complementing resources and features. Through cross-sector/industry exchanges and collaborations, they can integrate and speed up specific innovative technology application developments and promotions, especially focus on innovation verification and practical testing of service prototypes to increase the success rate of innovative businesses and the possibility of their continuous development.

Successful new technology-based services or product prototypes can attract international collaborations. The government can help startups with development potential by matching them with strategic partners, and give out subsidies or awards to international venture capital investors to encourage them to take part in angel or Pre-A cycle strategic investments. By leveraging the existing networks of international venture capital investors, we can increase the success rate of innovative startups and help them develop independently. The government can further encourage successful New Technology-based Service Industry operators to lead the development of key area innovative applications. Through direct investments, experience transmission, technical collaborations and other means, technology service startups can be invited onto the collaboration platform and jointly operate in New Ecosystems for Technology-based Services to increase whole project export numbers and enhance export competitiveness of our New Technologybased Service Industry.